Medicare SUPPLEMENT

WHAT ARE MEDICARE SUPPLEMENTS

Private insurance companies offer Medicare Supplement (Medigap) policies to cover the gaps in Original Medicare. These gaps can include some or all of the Part A and Part B deductibles and coinsurance, depending on the policy you choose. The lack of a maximum out-of-pocket limit in Original Medicare makes Medigap policies an essential aspect of healthcare planning.

Medigap policies cover all or most of the expenses that are not covered by Original Medicare Part A and Part B, allowing you to choose any doctor, hospital, or facility that accepts Medicare without any network restrictions. By combining Medicare with the peace of mind offered by a Medigap policy, you can be confident that your healthcare needs are protected.

If you want to keep Original Medicare Part A and Part B and add a Medicare Supplement, we can help you compare and evaluate your options from multiple carriers and plans.

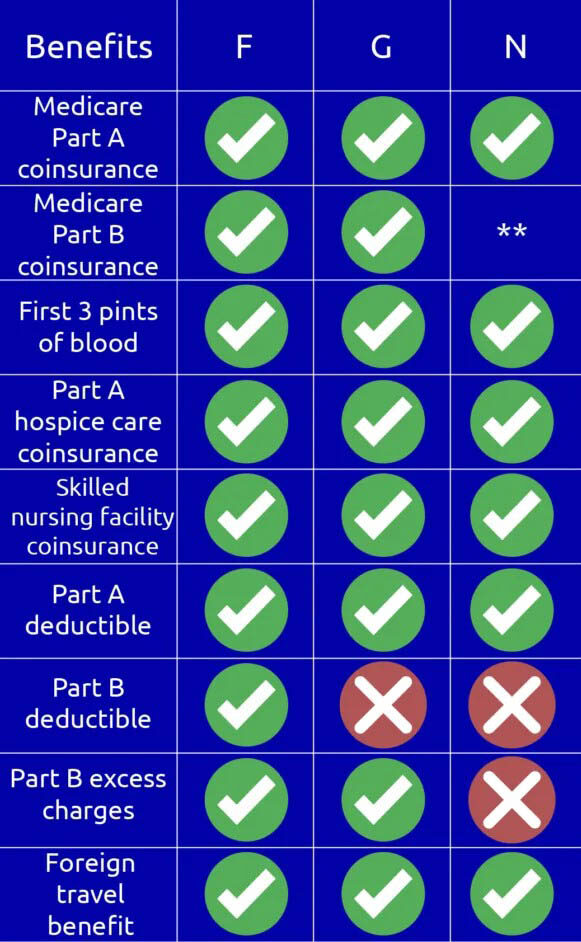

What is the difference between Medicare Supplement Plan F, Plan G, and Plan N?

Plan F covers the Medicare out-of-pocket costs not covered by Original Medicare Part A and Part B. Plus an additional 365 days after Part A Hospitalization benefits. Plan A is only available for those people turning 65 prior to January 1, 2020.

Plan G covers the Medicare out-of-pocket costs not covered by Original Medicare Part A and Part B, except the Part B Annual Deductible of $226 in 2023.

Plan N covers the Medicare out-of-pocket costs not covered by Original Medicare Part A and Part B, except the Part B Annual Deductible of $226 in 2023, $20 co-payment on office visits without treatment, and a $50 co-payment for Emergency Room visits that do not result in hospital admission.

When Can I Enroll?

It’s best to purchase a policy during your Medigap Open Enrollment Period (OEP). This window lasts for six months and starts on the first day of the month when you’re both 65 and older. It’s also possible with some companies to sign up for a plan 6 months prior to aging into Medicare but it will have an effective date beginning with your Part B effective date. Some people have group coverage for themselves and/or their spouses and when that coverage ends, you’ll have an opportunity to enroll in a Medigap plan without a penalty.

During your Medigap open enrollment or special enrollment period, you normally get better rates and have more options among policies. Also, a carrier can’t use medical underwriting to determine whether to accept your application. In other words, the carrier can’t do any of these things because of your health issues:

- Refuse to sell you any policy they offer

- Charge you more for a policy than they charge somebody with no health problems

- Force you to wait for coverage to begin (except as explained below)

The insurance carrier might make you wait for coverage affiliated with a pre-existing condition. Sometimes, the carrier can say no for up to six months, which is called a pre-existing waiting period. After six months, the policy will cover the condition.

Note: Medicare Supplement rules may vary per state.